For Private Markets

Better returns, better liquidity, better efficiency

Hazeltree provides Private Markets firms with a better way to manage their cash, credit facilities, liquidity, legal entities, and investor notices. Benefit from operational efficiencies and controls, reduced risk and exposure, and greater performance opportunities.

Schedule a DemoDownload PDF

Trusted by the Best

Efficiency Unleashed

Transparency and Efficiency for Tighter Counterparty Management

We transform the way Asset Managers manage their counterparty interactions to optimize fees, minimize exposure, and protect assets. Transparency and Efficiency for tighter Counterparty Management:

Get StartedEfficiency Unleashed

Transparency and Efficiency for Tighter Counterparty Management

We transform the way Asset Managers manage their counterparty interactions to optimize fees, minimize exposure, and protect assets. Transparency and Efficiency for tighter Counterparty Management:

Get Started

Optimize Performance

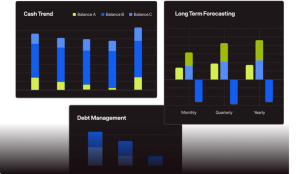

Unlock trapped liquidity and use enhanced data to make optimized decisions on cash and debt.

Risk Mitigation

Efficiently manage cash with consolidated views, reducing risk and enhancing control. Empower the team to focus on value-added tasks for strategic impact.

Real-time Insights

Use timely, enhanced data to redeploy capital strategically, delivering improved returns for investors.

Flexibility

Adapt to changing fund needs with Hazeltree's flexible treasury solutions. Open connectivity integrates seamlessly into your operational workflows.

Products

Explore Our Comprehensive Product Suite

Treasury

Reduce Risk, Increase Returns, Maximize Control

Seamlessly consolidate banking, brokerage, and counterparties on a secure, unified platform.

Learn More

Liquidity

Precision Liquidity Management

Utilize sophisticated algorithms for just-in-time execution, model bank credit facilities confidently, and streamline capital lifecycle management.

Learn MoreHazeltree can assist with all aspects of cash flow management, including forecasting and optimization.

Let one of our experts show you how our treasury management software can remove operational friction from your firm. Book a demo now.

Hear it from Our Partners

Hazeltree has demonstrated an understanding of our specific needs and helped us convert our complex operational processes into an automated solution. We now have an enterprise view of our capital activities, and can move cash, initiate capital calls and more effectively support our investor demands.

Chris Corrao, Managing Director and Head of Operations