For Hedge Funds

Unlock Enhanced Returns with Hazeltree

Discover a revolutionary SaaS-based Treasury, Liquidity, and Portfolio Finance system designed exclusively for investment managers and Hedge Funds. Hazeltree's solutions eliminate transactional friction, boost operational efficiency, and provide key decision-making insights, empowering you to maximize returns.

Schedule a DemoDownload Fact Sheet

Trusted by the Best

Efficiency Unleashed

Streamline Your Investment Management

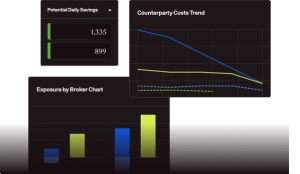

We transform the way Asset Managers manage their counterparty interactions to optimize fees, minimize exposure, and protect assets. Transparency and Efficiency for tighter Counterparty Management:

Get StartedEfficiency Unleashed

Streamline Your Investment Management

We transform the way Asset Managers manage their counterparty interactions to optimize fees, minimize exposure, and protect assets. Transparency and Efficiency for tighter Counterparty Management:

Get Started

Increased Control

Efficiently manage cash with consolidated views, reducing risk and enhancing control. Empower your team to focus on value-added tasks for strategic impact.

Flexibility

Adapt to changing fund needs with Hazeltree's flexible treasury solutions. Open connectivity integrates seamlessly into your operational workflows.

Better Returns

Gain timely insights for superior decision-making. Redeploy capital strategically, delivering improved returns for investors with our timely, enhanced data.

Reduced Risk

Centralize cash and payments ops for disaster recovery and control. Automation mitigates data and operational risks, empowers staff, and safeguards against succession issues.

Products

Explore Our Comprehensive Product Suite

Treasury

Reduce Risk, Increase Returns, Maximize Control

Seamlessly consolidate banking, brokerage, and counterparties on a secure, unified platform.

Learn More

Liquidity

Precision Liquidity Management

Utilize sophisticated algorithms for just-in-time execution, model bank credit facilities confidently, and streamline capital lifecycle management.

Learn More

Finance

Securities Finance, Margin, and Collateral

Control, monitor, reconcile, and benchmark your counterparty and custodian-related operations.

Learn More

Data Insights

Unrivaled Hedge Fund Market Intelligence

Unparalleled insights into market rates for hedge funds and other alternative asset managers interested in market structure and trends.

Learn More

Sweeps

Sweep Cash Into Money Market Funds

Optimize your returns by efficiently sweeping excess cash into money market funds.

Learn MoreBy the Numbers

Hear it from our partners

GenII Fund Services

Effective treasury management is essential to maintain financial stability, optimize cash resources, manage financial risks, and make informed financial decisions to support growth and profitability. We utilize Hazeltree software to provide innovative cloud-based treasury solutions to investment management firms, delivering enhanced transparency, liquidity, improved performance, and risk mitigation.

Matt Cammer, Director, Head of Treasury