Trusted by the Best

What We Do

Purpose-built for investment management and private markets firms, our solutions deliver enhanced transparency, liquidity, and risk mitigation. Our clients increase returns and gain tangible business value by optimizing counterparty interactions, credit facilities, margin requirements, fees, and more.

Book a DemoSolutions

Solutions

Hedge Funds

Discover a revolutionary SaaS-based Treasury, Liquidity, and Portfolio Finance system designed exclusively for investment managers and Hedge Funds.

- Efficiently manage cash with consolidated views, reducing risk and enhancing control.

- Redeploy capital strategically, delivering improved returns for investors with our timely, enhanced data.

Solutions

Private Markets

Utilize a better way to manage your cash, credit facilities, liquidity, legal entities, and investor notices.

- Unlock trapped liquidity and use enhanced data to make optimized decisions on cash and debt.

- Open connectivity integrates seamlessly into your operational workflows.

Products

A suite of best-in-class Treasury Management products

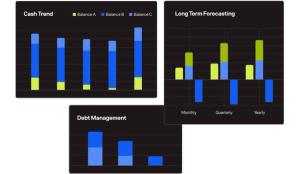

Treasury

Reduce Risk, Increase Returns, Maximize Control

Seamlessly consolidate banking, brokerage, and counterparties on a secure, unified platform.

Learn More

Liquidity

Precision Liquidity Management

Utilize sophisticated algorithms for just-in-time execution, model bank credit facilities confidently, and streamline capital lifecycle management.

Learn More

Finance

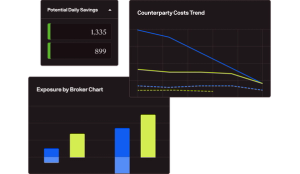

Securities Finance, Margin, and Collateral

Control, monitor, reconcile, and benchmark your counterparty and custodian-related operations.

Learn More

Data Insights

Unrivaled Hedge Fund Market Intelligence

Unparalleled insights into market rates for hedge funds and other alternative asset managers interested in market structure and trends.

Learn More

Sweeps

Sweep Cash Into Money Market Funds

Optimize your returns by efficiently sweeping excess cash into money market funds.

Learn More