Back to index

State of Treasury Management 2024 for Hedge Funds

![SOTMimage[1].png](https://cdn.sanity.io/images/882clh4e/production/a5d01754af22a89dd2913d4c6e625487daae8c1c-670x414.png?w=300&auto=format)

Download report as PDF

Download nowWe now sit seven quarters removed from when the U.S. Federal Reserve and other central banks began raising interest rates in an effort to combat inflation, and it’s become clear that “higher for longer” is now the expectation and assumption for the foreseeable future among the investment management industry.

Inflation is a key metric dictating this sentiment. While inflation has come down from its peak in the summer of 2022 and has stabilized to some extent, it remains stubbornly high. The December 2023 CPI reports an increase of 4%, up from 3.9% in November 2023.

As a result of these economic conditions persisting, hedge funds and other investment managers have seen their hurdle rates rise dramatically, putting pressure on managers to cut costs and find ways to boost performance to meet those loftier expectations.

Impact on Treasury and Operations

In times like this, firms tend to look inward at key cost centers, such as operations and finance, as natural places to try and find efficiencies.

Treasury is a particularly important function to focus on since it’s an area where firms can cut costs as well as uncover new opportunities for a firm to turn treasury into a profit center.

It comes down to putting capital to work and limiting the amount of “lazy cash” that can hamper potential returns.

Taking a step back to assess 2023 in the context of treasury and financial operations, collateral management and securities finance stood out as the main areas of focus for investment managers among Hazeltree clients.

Spotlight: Collateral Management

Efficiency in collateral management is an area where we’ve helped many of our clients this year. Given that firms have to pledge collateral to their brokers for a number of different trades, whether it’s for repos, OTC derivatives, cleared derivatives, futures, etc., doing this efficiently at scale can become unwieldy very quickly.

As market volatility increases, often so does trading volume and the frequency of collateral sent and received. The more inefficient an organization is, the more idle money it leaves on the table and the more risk it incurs.

It’s worth noting that the onus is completely on the firm to keep track of their collateral obligations since brokers aren’t incentivized to notify those that are overcollateralized. In spreadsheet-based organizations, the tendency has been to eyeball collateral calculations with the aim of being overly conservative. Many firms who have taken a “if it ain’t broke, don’t fix it” approach to pledging collateral are waking up to the realization that there is a better way.

Given the economic environment, financial incentives are now more obvious than they might have been in the past. An extra $1 million in collateral can be put to good use– for example, in high-yielding money market funds or reinvested into the manager’s own strategy – and can contribute to the overall health of the fund’s performance.

Firms that can automate and control this data daily – to identify how much excess there is, create the movements, execute wires, and show when they’re settled and when they fail – can significantly reduce their error-prone manual touchpoints and ensure the maximum amount of capital is working on behalf of the fund.

Spotlight: Securities Finance

If more efficient collateral management is optimizing how many oranges (cash) you can harvest from a grove, securities finance is the ability to squeeze as much juice out of those oranges as possible, which also requires an eye for efficiency. Data can be considered the ‘oil’ in this ’engine of efficiency’ by providing the information needed to multiple stakeholders in the firm, from operational groups, research, and risk areas to the portfolio managers and the C-suite. In times of high volatility, this is key. For example, internal research groups focused on securities finance can develop new strategies and determine the optimal time to get into or out of positions across different regions and sectors.

They can also monitor when a certain stock reaches a specified level of liquidity or illiquidity and assess the potential for short squeezes. They can identify illiquid stocks andconstructportfoliosthatarebasedupon their ability to obtain lending revenue. In addition, the securities finance group can alert the portfolio manager when data show that a particular security is heating up and a potential trading opportunity emerges. The portfolio manager can analyze the history andmultiplerelevantmetricstotestagainst any proposed trading model.

Automated platforms and modern data management systems allow traders to access data that can help make decisions to minimize financing costs, maximize borrowing capacity at their prime brokers, and optimize the allocation of borrowing across counterparties.

The move to T+1 settlement for equities in May 2024 is also pushing the industry towards the adoption of more automation, which will require working within tighter timeframes for money movement on a day-to-day basis. We will be placing additional focus in this area on behalf of clients in the year ahead.

What We Expect in 2024

Economic outlook

The expectation is for interest rates to remain at current levels for the next two to three quarters, with potential rate cuts coming at the end of 2024. However, even if theFeddoescutrates, those cuts will likely be minimal. The impact of the presidential election in the U.S. cannot be downplayed in these scenarios.

Wall Street is divided about how aggressive rate cuts will be. On the one hand, UBS Group AG and Morgan Stanley each anticipate deep interest-rate cuts in 2024. On the other hand, Goldman Sachs analysts expect fewer reductions and a later start. Despite some industry disagreement as to the size of the rate cuts or when exactly those cuts may occur, there is little doubt that rates will continue to be elevated compared to the last fourteen years.

Technology trends

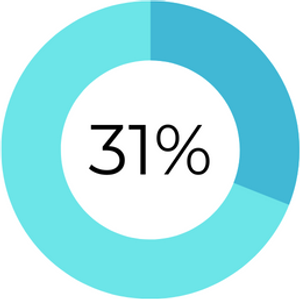

A technology trend we’re catching closely is the advancement of distributed ledger technology (DLT) and the tokenization of assets. Digital assets, in general, are something we’re building for, as many of our clients are interested in these next-generation asset classes. According to a 2023 AIMA survey of crypto and traditional hedge funds, 31% of traditional hedge funds view tokenization as the biggest opportunity.

We anticipate supporting our clients’ ability to move these assets efficiently in the future. An example of a deal we’re watching is the recent funding secured by blockchain payments firm Fnality, led by Goldman Sachs, BNP Paribas, DTCC, Euroclear, and a host of other industry players.

Where Hazeltree is investing

In 2024, we’re working on an automated workflow where the system can identify a client’s full use of collateral agreements and can then make the margin call, book the movement, and create a SWIFT message—all without any manual intervention. In addition, we plan to expand our Liquidity Investment Platform (zLiquidity) to enable our clients to efficiently invest their idle cash in an array of investment choices.

Hazeltree will continue making significant investments in our platform and capabilities to support our clients’ future needs. Those investments will be aimed at introducing more automation into the platform overall, including on the collateral management side, to become more efficient and reduce risk and costs.