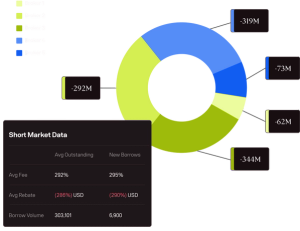

Securities Finance, Margin Analytics, and Collateral Management

Hazeltree Finance is a cloud-based platform for alternative investment managers to generate alpha from their treasury function through improved transparency, control, and benchmarks of their counterparty and custodian-related operations.

Get Started